Yup. Bought at the end of 2019, refinanced in late 2020. Currently have a 15 year mortgage at a fixed 2.1% APR. I literally cannot afford to give this up.

It’s less that I want to leave this house, specifically, and more that I just want out of this state. For multiple reasons unrelated to my good mortgage deal, I’m stuck here for the foreseeable future.

On the bright side, I never thought I’d actually own a house so I’ll take the win.

Ditto. 2.6%. Car loan at 3.2%. Can’t afford a new car, can’t afford to move these days. Yeah, it’s hard to bitch when you’re glad to have a home, but it’s a figurative “house arrest” when market forces trap you.

Yep, 2.7% here. Bought in summer 2020. I really like the house, but the property is challenging as its a big slope. I didn’t realize all the challenges in dealing with that. However, it’s starting to grow on me and I’m still getting what I want out of my land its… just… more work and money. I got such a good deal it doesn’t make sense to leave.

Car loan at 3.2%…

I’m so envious, I’m buying a car rn and I’ll be lucky to get 9% or 10%

NFCU. Has the best auto loan rates I’ve seen or heard of anywhere right now. I’m not sure if you’re eligible, but worth looking in to.

https://www.navyfederal.org/loans-cards/auto-loans/auto-rates.html

10%?!

Holy shit.

Yeah, and that’s with a good (mid 700s) credit score.

I had a place try and reel me in at 14% the other day and I would have laughed if I wasn’t so taken aback. Like, they are closer to the maximum rate than the average…

I might just be unlucky with the dealers I have been to. Unfortunately the ones I’ve heard good things about only have cars out of my budget.

Brutal, and on top all the dealer premiums and markups.

a fellow texan?

WV. Not worse, just differently bad.

Don’t you have to renew it every 5 years?

Nope, US has 15 and 30 year fixed rates available. You can get an arm that has a variable rate, but they’ve been un popular after 2008, and with the low interest rates not worth it.

Holy shit. We don’t have that in Canada. I wish we did. A lot of people have lost their homes due to raising interest rates as they have to renew every 5 years or so. Real estate in Canada is so fucked up.

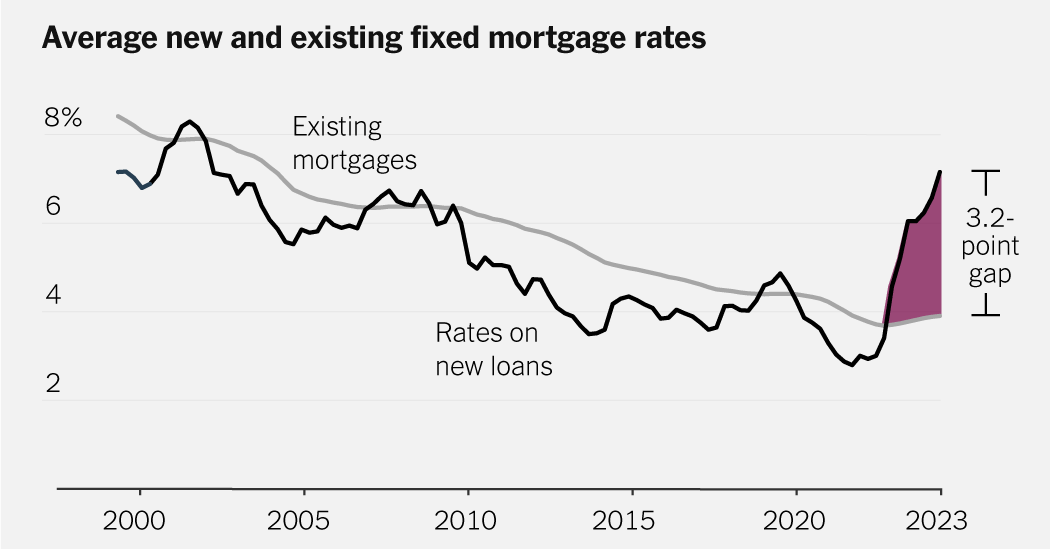

The US is unique in the 30 year fixed rate. It’s great if you have one, but it can have some externalities and effects like what we see here.

Wow! I did not know that! You essentially refinance your home every 5 years? How does that work? With new closing costs and everything?

Not who you were talking to, but no, the closing costs are one time only. You basically just renew or get a new mortgage somewhere else. Ours is coming up in October, we’re a bit worried but hopeful it won’t be too bad. We’ve got wiggle room as we got a great deal on our house but it’s still going to suck. I have seen a 10 year fixed, might go for that if we can get a good enough rate.

What a scam. Forcing you into new higher interest rates.

i would have killed for that. got a 1.8% 20 year morgatge in 2021, would have loved to lock in at that.

That’s not a thing in the US like it is in Canada. I can keep my sub 3% mortgage for the 25 years I have left on it.

There are Adjustable Rate Mortgages in the US too. My sister-in-law lost her house a while back where her rate went up. I think they lock you in at a low rate for the first 5 years and then they go up. It sounds like a good idea if you’re confident that rates are going to stay low and your home will increase in value making it easy to refinance. But in reality, no one can predict the market 5 years out, so I wouldn’t recommend it.

I haven’t heard of having to renew mortgage interest rates. A fixed interest rate should be good for the life of the loan.

I’m at 2.875% on a 25-year loan. I never plan on moving.

Depends on where you live. Odds are most people reading this are in the US or Canada where fixed interest rates for life of the loan is common, though you can get an ARM. However in many other countries you cannot get those loans, and those people have to renew every few years.

Not Canada. Highest I’ve seen is 10 year, most of the time it’s 5.

I stand corrected.

I wish we had a 30 year! That would be amazing in some ways. I have to renew this year and I’m not looking forward to it.

15 and 30 year fixed mortgages is pretty unique to the US.

In USA, refinance happens only when consumer wants to. Usually to get a better rate or cash in on some equity I think.

In Canada, the mortgage has to be renewed every 5 years or less depending on your contract. They’ll never let you have a 30 years mortgage on a 2% interest rate the whole time.

So what happens if you go to renew and they’re like “screw you, 8%”, and you can’t afford that increase? Do they just foreclose your house?

Well if you can’t afford it, you take a temporary mortgage with the objective to sell.

Otherwise you add a lump sum to reimburse the capital to reduce your payments.

Different banks will offer different rates as well so you can shop around and negotiate.

We have to renew in Oct and we were looking at BMO and they have a 10 year fixed now.

Nope :)

I think you may be thinking of an ARM (adjustable rate mortgage) where the bank recalculates the interest rate every few years based on the current federal rate (I’m not a money-ologist, but I think that’s the broad strokes of it).

I pay 2.1% APR until it’s paid off or I choose to refinance again (lol, right). The only thing that changes my monthly payment are the stuff paid from escrow (property taxes and homeowners insurance) since those can vary and the bank takes care of those by folding them into my payment amount.

No who told you that? If your interest is fixed you don’t fuck with that

In the UK it’s quite unusual to have a fixed rate mortgage that goes that long. Normally you’d get a decent rate for 2-5 years, at which point the rate changes to whatever the current default is, and you get the opportunity to fix for another few years

Well mine isn’t it fix 30 years. You can get one of those our a floating rate but goddamm I was told to only get a fixed 30 year mortgage. Correct that most people do refinance in 5 years but in today’s market no fucking way.

Somehow I think that would be great for un-fucking our “home investment” slave system in the US where landlords buy all these homes on credit, convert them to multifamily, and then use the labor of renters indefinitely while allowing the homes to get worse and worse.

It would solve that one problem, but would create so many more and much larger problems.

Of course, anything in a bubble without considering how to mitigate effects is going to be a problem. If it was just a single change necessary it would have already been done.

Canada. Different rules here. I thought it was the same all across the world.

Not sure what makes you think this, but most mortgages are a contract for 15 to 30 years that lock you into a rate until the house is paid off. You may be thinking of some kind of variable rate mortgage but I though those renewed the rates way more often than 5 years but I’m not sure. It’ll all depend on the mortgage terms.

The U.S. is the only country in the world where the 30-year fixed rate mortgage is the most popular way that people buy houses. It’s the deliberate result of government policy—government-sponsored enterprises Fannie Mae and Freddie Mac buy mortgages from lenders, ensuring that they continue to offer such loans at little risk to themselves.

All the non-Americans here can’t get 30 year fixed mortgages, that’s why a good part of the Lemmings here are confused

30 year fixed rate with a 30 year pay-back period is available in the Netherlands too, but most people take the 20 year fixed rate for a 30 year repay period, because it’s lower interest, and after 20 years, the remaining principal is pretty low.

Same exact situation. But I has daughters in a state that just upheld a civil war era law enacted to ban abortion prior to women being able to vote. We made a good amount of cash off the sale but now have to rent at almost twice what my mortgage was. Both my house and the Apt. I am in now in are owned by investment firms. This will be untenable.

Bought ours in January 2018 no way could we afford to give it up our refinance no matter 75k in equity. But our mortgage keeps pushing us too. I have click through 6 offers to refinance just pay my mortgage online each month.

Same, except for a slightly higher interest rate. My property value has gone up so much and I paid enough down that I could sell and go buy a really nice house in a shitty little town or rural area with cash and have no real bills. I could afford that. I just don’t want to leave the convenience of my city.

So I can’t leave and honestly I really don’t want to yet. I’ll leave when I retire.

Rent it out and move. Easy.

In the greater Boston area, rents are much, much less than interest costs on a mortgage.

It’s very common right now to see a rental go on the market only for them to not get a renter and then for the house to be for sale within 6 months. ROI is plummeting compared to other investments but prices stay steady because so many want to buy a home.

That’s fascinating.

I wish there was a map of places where that happens. Not necessarily a cost to rent or cost to own, but a % difference between renting and owning.

In my city, mortgages are about 60-75% the cost of renting.

I think with a large enough sample size a lot of useful inferences could be drawn about how zoning, population density, and local renting laws impact that ratio.

There are condos for boston right now that would rent for 4000-5000/mo (like 2br/2ba) but are listed for sale for 1.35-1.4 million dollars. The mortgage on these things would be like 9k/mo. This is not the common property though, just an extreme example.

I put an offer down on this small multifamily with a total of 4br and 2ba (3br 1ba main unit and 1br 1ba sub unit) and the mortgage was looking like 5k-5.5k/mo with 20% down. Rental for 3br might go for 2400-2800 and a 1br is around 1600-1800. So combined let’s call it 4300/mo for an investor. That’s a $700+/mo lost cash per month assuming you get renters. If you can’t find a renter for that 3BR unit… you’re heavily boned.) It just doesn’t make sense imo. Plus combined in the area I was looking at buying the unit, it has a penalty for non owner occupied property taxes. Plus the 1br unit needed the kitchen floor to be completely redone. I heard an investor at the open house talking about converting the nasty basement into a 3rd unit too.

Also all houses are going for about 10% over asking here, all contingencies except the mortgage one is waived (you must wave inspection. No one is accepting offers contingent on inspection in the suburbs of boston today in 2024.) A great deal many of offers show up waiving mortgage contingency as well, implying cash offers, but the last sellers agent I spoke to suggested waiving that to look like a cash offer and taking the risk of losing your job before the sale closes. It’s fucking wild

If a house doesn’t sell on it’s opening weekend it’s going to get cut every week until it finally goes. Being a greedy seller is really disadvantageous, but being just under value causes bidding wars.

If you have a mortgage condition you have an inspection condition. Lenders aren’t giving you 500k for a house with a cracked foundation.

It’s not the same as a traditional inspector though where you can negotiate some changes or fixes or money. Appraisers don’t seem to be very rigorous.

Ha, possible. Though I don’t want to be an absentee landlord or deny someone else an affordable home. Would definitely sell :)

I recently gave up my 3% mortgage from 2013 in exchange for a 7% mortgage. It hurts, but it was worth it to get out of Florida.

In the end, my housing costs actually didn’t change that much because my home insurance rates were skyrocketing.

but it was worth it to get out of Florida.

You could put almost any horrific thing in front of that phrase and it sound valid.

I had to keep my arm in a tub of fire ants for 5 minutes, but it was worth it to get out of Florida.

I had to cut off several limbs leading to a bad case of sepsis…

I had to sell a few children (not mine) along the way engage in some other morally questionable activities…

I had to sacrifice my first born like Abraham did his Isaac…

…but it was worth it to get out of Florida

It reads like a country song…

🤌

I could not agree more. The flip side is likely true as well…

“I’d rather put my arm in a tub of fire ants for 5 minutes than move to Florida. “

Also home insurance isn’t tax deductible (to my knowledge unless you’re renting the house and then it counts against the income you made renting) but the interest paid is.

That’s a good point, but I’m definitely paying more taxes now than I was before. My new state has income tax and tangible property (vehicle) tax that Florida didn’t have. I looked up tax distribution for my county and the majority goes into education, so I can’t complain too much.

I’m in year 17 of my 5 year starter home. I can’t afford to upgrade now. I’m gonna die in this house.

Hey, don’t be so glum. You could die at work for example.

I work from home lol

Ok yeah you’re gonna die in your home

Nice, you’re both right.

Yeah! It’s nice when we can all agree about where that guy is gonna die.

Same story as everyone else. Bought pre-covid, refinanced, now sitting pretty. We desperately want to move, but I would have to make like $50k more a year for the same quality of life.

Rent it out or sell it and move. How is it not a wash for whatever u want to buy?

Because interest rates are way higher now?

Uhh, because of interest rates. The very thing being discussed here.

I don’t know where OP lives or how much their house costs, but a $400,000 home at 3% is around $1,685/month. Same price at 7% is about $2,660/month.

If it were in a more expensive neighborhood, a $1 million dollar home at 3% is about $4,200/month. At 7%, that makes it $6,650/month. Many average houses in California can cost $1.5 million… so needing an extra $50k/year sounds reasonable to be able to move into a similar house.

You have to get a new loan when buying a different house unless you have the money to pay cash. That means you accept the current rate. I wouldn’t want to spend an extra grand or two per month on a similar house.

Had 30 yr 3.84%, refinanced in 2021 to 15 yr 1.999%. it’s the cheapest money I’ll ever have.

Kinda strange reading all these comments about how people dislike their house and where they live, but can’t imagine giving up their mortgage rate.

The almighty mortgage handcuffs, the true American dream.

Oh look it’s me. 3.125%

My wife and I LOVE our house and don’t want to leave, but we definitely thought it was going to be a starter home. We straight up could not afford the mortgage payments anywhere else at today’s rates, even in a much smaller house

I couldn’t afford to buy the house I currently live in, today. The “value” of my house almost doubled in value, and interest rates are close to triple what I have now. There is no way my family is going to move out, it’s pretty stupid that an upgrade of a home, in terms of dollar value, would put me somewhere much smaller.

2.875 here, my monthly payment is $545. I want to move, but it would be financially stupid to do so

Basically, unless the sale gets you enough to buy the next house in cash, it’s a bad idea, lol.

The value of my house has gone up by about 50% so I could definitely put the money forward, but it still would be a questionable decision.

Oh, yeah. This isn’t the house I wanted to die in, but unless we have another near-negative interest rate drop, we’re here for the long term.

“Are you willing to relocate?” has now become a hard “no.”

And people moved away from cities during COVID to decrease their cost of living and get a bigger place while still being able to work from home. They bought with lover interest rates in their mortgage.

Now employers want a return to office. The employees can’t afford to move back.

Also a lot of people have discovered that no one wants to live in rural areas because they fucking suck. That’s why there’s no people there.

People don’t live in rural areas primarily because of the distance to their jobs and a lack of infrastructure. Otherwise most people would choose rural living over living in a dense city if all other factors were equal.

Closeness to nature, lack of pollution/ city noise, free use of the earth and land, etc.

[citation needed]

I greatly enjoy not having to drive 30 minutes to get groceries or run errands. I very much enjoy dense urban areas where everything is within walking distance or good transit.

Throw in a nice park and some greenery and I’m good. I frankly think most people would pick that than a car centric plot in the middle of nowhere.

For me, it’s not just the closeness of things, but also having a dozen good options for eating takeout, or numerous local coffee roasters or bakeries. I love the idea of living closer to nature on the big island of Hawaii but, it would be rough. To bring the things I love with me I’d also have to roast my own coffee, bake my own bagels and pizza, and brew my own beer. Basically it would be a full time job. I’m happy that these things are still available to me as hobbies, but they are easily outsourced in a real city. And it’s not like you can’t find pizza or beer or coffee on Hawaii, but the quality and variety of those things falls short of what you’d get in a bigger city.

fuck that! give me nyc. I love nature but it’s so inconvenient. it’s something to visit.

Yep it’s awesome to be free of all the hassles of city life, living out in the woods basically with room to do whatever. The air is clean and fresh, and I can piss in the yard day or night.

Being close to a small town, I can even access groceries and restaurants within 10 minutes. Fiber internet is available and affordable. Wouldn’t trade it for any city.

Are we like not even allowed to talk about renting out our home in order to upgrade or something? That’s the play right now. Net present value of your almostfree money is maximized by turning it into cashflow. Plus you don’t blow 6% on closing costs, and it’s all the same to the bank in terms of getting another loan. It actually ends up being an equity asset as well as income.

Err, what I meant to say was murder all landlords.

It’s possible, if you have the savings for a second down payment. I’m pretty sure you also lose certain tax advantages if you convert your primary home to an income property. Depending on how long you’ve owned it, that can work out to a serious hit.

You can’t deduct the mortgage interest (you can on the new primary residence though), but suddenly every dollar you spend on the rental property is tax deductible as a business expense. And you can like deduct depreciation on the appliances and shit. It’s actually more tax advantaged in some situations.

Check with an accountant. In some cases you are better off not taking a deduction. It depends on a lot of factors that an accountant whould know.

Yeah, I have a lot of experience in this area, including accountants and lawyers.

Bought my house just before the crash in 2007. Felt screwed over as I went underwater and was stuck with my 6.5% loan while interest rates and home values plummeted (and because my mortgage was privately held, no HARP refi option.

Finally after nearly 15 years not only go out from under water but built enough equity for a no cost refinance. Got into a 2.25% loan.

Sad part is, despite the lower rate, due to skyrocketing insurance and taxes, my payment is no cheaper

Taxes and insurance is what will knock a lot of us out

3.25% 30 year… 27 years left.

But I’m OK staying. I’ve made huge improvements. Upgraded the electrical panel from 100A to 200A, added solar panels, added a retractible awning. Hot tub is coming.

It’s a nice house, with a good yard, will be fun to add playground stuff when we have grand-kids.

Not trying to throw shade at your shade, but I don’t think the retractable awning is building a lot of equity.

It’s a freeing feeling when you decide to put money into what you want instead of what has the biggest ROI.

It basically created a 3rd patio space.

I’m one of them. For a lot of reasons my partner and I want to move, but we have a 3% mortgage. Even though we have a large amount of equity, we still can’t afford to buy now. I’m looking a getting a loan from my parents, which is ridiculous considering our situation but almost 8% interest rates mean our payment would just about double from what we have now.

I know. It’s pretty nuts. We’re in the same situation. We want to move, but it makes no financial sense to sell our house with such a cheap mortgage. So we’re thinking about just renting it out for a few years and move into a rental where we want to live until it makes sense to sell. Keep building equity in the meantime. But it may never really make a 100 percent sense to sell.

8%, wow. I remember when it slowly (over years) came down from 17.5% in 1990 in Australia. My credit card at the time had 55 days internet free but the internet was 18.5%, at one point I think it hit 22%.

Credit card rates are similar to that even now in the US but for a while we were at about 2% for mortgages. Mine is 2.75%. Selling this house at some point is going to hurt.

Lucky 'mericans. In Canada, fixed mortgages are still renegotiated every 5 years or so, nearly every homeowner with a mortgage is getting wrecked by the interest rates.

We get wrecked by other things. Healthcare costs is my wrecking ball.

I’ve found a simple fix for this by just not getting medical care ever

deleted by creator

In the UK, we have various mortgage products. You can choose to track the national lending rate (plus some %), standard variable or fixed rate for various periods. Of course they calculate the rates for the various periods based on risk.

Right before the rates really started going up, we managed to get 10 years fixed at a very reasonable rate. The mortgage advisor thought we were crazy and that this was “all going to blow over in no time” and was advising a tracker until “the rates returned to normal”.

So this could actually trigger a crash if many need to sell but can’t buy.

Variable rate mortgages and loans are also available. They have not been as popular in the past few years, but when rates were lower, they were more common

You’re absolutely correct!

Its less of a problem of lock in here in Australia. Our rates tend to only be fixed for the first few years. Then you go to the variable rate. We have an opposite problem, where we have what’s known as a mortgage cliff. People who signed up at affordable repayment amounts end that lock in period and have payments jump significantly. Some are forced to sell.

Being locked in seems better than being forced to sell.

I would like to introduce you to 2008…

Yes, just America was affectednbynthe global financial crisis. Unless you mean the sub prime rates, which ISNA different thing than fixed rates. Usually those on a sub prime rate are on a higher rate not lower.

Here in Germany you can decide how long you want your rates to be fixed, with the tradeoff being that longer times of fixed rates usually have slightly higher rates (in German its Zinsbindung).

I am lucky and happy that I chose to do 30 years fixed rates, after those 30 years I only have like 2k€ left anyway, so it doesnt matter what rates I get then really.